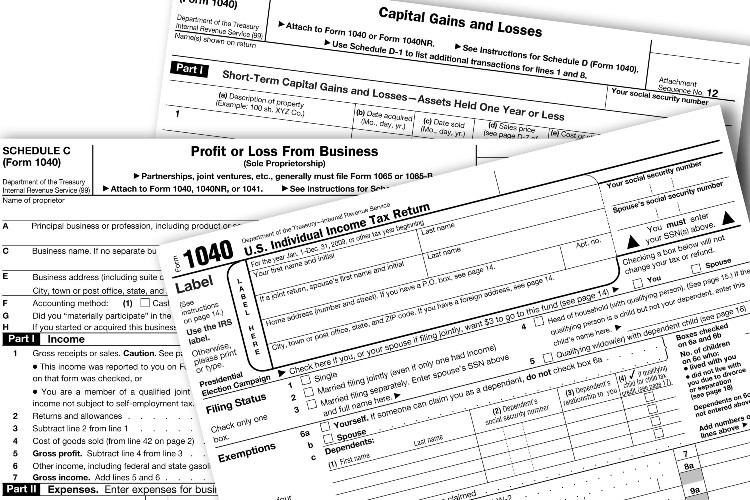

2024 1040 Schedule 40 Instructions – When you decide to close your sole proprietorship, there are no special instructions to follow, except what is normally required for sole proprietorships. Complete IRS 1040 Schedule C . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

2024 1040 Schedule 40 Instructions

Source : twitter.comWhen will the IRS close the Tax Season? Every state is different

Source : www.tododisca.comUnited Way of Connecticut on X: “It’s tax season, and 211 can

Source : twitter.comBeyond Pro Consultants LLC | Chicago IL

Source : m.facebook.com1040 (2023) | Internal Revenue Service

Source : www.irs.govBoyertown Community Library | Boyertown PA

Source : www.facebook.comTax season is under way. Here are some tips to navigate it. 93.7

Source : 937kcountry.com1040 (2023) | Internal Revenue Service

Source : www.irs.govGet Free Help Filing Your Taxes Online or In Person in NYC

Source : neighbors.columbia.eduAmazon.: 2024 Latest Missouri Labor Law Poster State

Source : www.amazon.com2024 1040 Schedule 40 Instructions Reddy & Neumann, P.C. on X: “New Year, New Tax Returns💸 Dive into : The amount is added as “gambling income” on line 8 of your Form 1040, Schedule 1, which is used to report types of income not listed on the primary 1040 tax form. That total is then added to Form . The Internal Revenue Service (IRS) has released the Schedule 3 tax form and instructions for the years The Schedule 3 tax form is part of the 1040 tax return. Taxpayers who are eligible .

]]>